One of the first questions anyone considering investing in a short term rental often asks is, “how much money will this make me?”. While it appears to be a simple question, the answer is far more complex. The amount of money one can make from an Austin short term rental investment is directly correlated to not only the property attributes, such as the location, size, and amenities, but also to the management efforts. If you aren’t running your airbnb properly, adjusting pricing regularly, updating your listing often, and handling guest inquiries with the speed and attentive service of a Nordstroms’ shoe salesman, you may be leaving money on the table.

That being said, it's important to understand the general income potential and market trends in different areas so you can decide where you might want to invest. That’s why I recommend you use these average values for just that purpose, to compare different markets. When you want to truly dive into the income potential of a specific property you’ll need to do a bit more research by looking at specific comparable listings and how well they are or are not managing their airbnb. We are experienced deal analyzers, so if you need help when it comes time to evaluate a given property's Airbnb income potential, don’t hesitate to contact us.

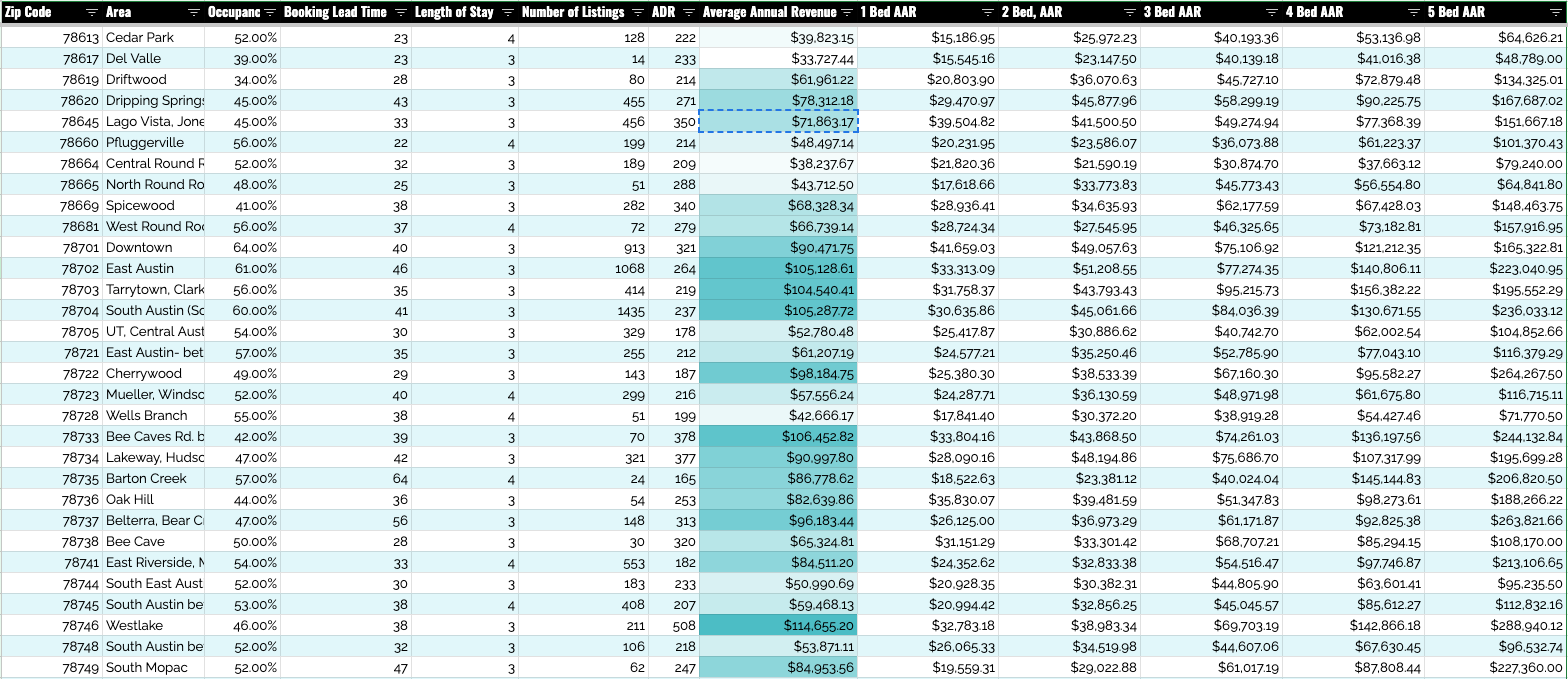

Back to the point of this post, there are a variety of stats that can help you understand Austin’s airbnb market. Looking at average annual rental income, occupancy rates, and average daily rates (ADR) will give you a sense of Austin airbnb income trends across different neighborhoods. We’ve said it before, and we will say it again, AirDNA data is not perfect, but for the purposes of this post we will be relying on data from airdna.com. In Austin, which AirDNA data defines as a property that has an Austin address and full disclosure that doesn't necessarily mean the home is actually in the city limits, the average occupancy rate is 61%. Average Daily Rate (ADR) for Austin Airbnb properties is $232, and the average annual revenue is $37,152. To me, these numbers look pretty dismal. But, that’s because they are averages. They are the average of a shitty one bedroom apartment that Joe decided to take photos of with his flip phone and then post on airbnb, the couple who only list their home for SXSW, and the pros who are decking their airbnbs to the nines - turning closets into 6th bedrooms, installing cowboy pools and hosting bachelor parties every weekend.

If you dig into the specific stats for hyper local neighborhoods you can start to get a better picture of where to invest in an airbnb in Austin. It should come to no surprise that the neighborhood with the highest average annual airbnb income in greater Austin is Westlake - one of, if not the, most affluent neighborhoods in the entire city. Westlake Airbnbs pulled in $114,655.20 in annual revenue in 2022, and the average occupancy rate was only 46%. In the hip neighborhood of East Austin, we saw an annual average airbnb revenue of $105,128.61, but airbnbs in 78702 were also booked more often. In East Austin, the average occupancy rate was 61% last year.

What about airbnbs a little further out? In Dripping Springs, the average occupancy rate was only 45% last year, but STRs in Dripping pulled in $78,312.18 on average in airbnb income. Across town on the north shore of Lake Travis in the 78645 zip code, home to well-established vacation rental markets like Lago Vista and Point Venture, airbnb owners pulled in $71,863.17 in average airbnb rental income last year.

As you can see, the average income for an Airbnb in Greater Austin varies greatly depending on the location. And, income is not necessarily consistent throughout the year either. There are a variety of seasonality factors that can have a significant impact on your Airbnb income too. In Greater Austin, during popular events like SXSW, Austin City Limits Music Festival, and the Formula 1 US Grand Prix, nightly rates can increase by as much as 200%. Homes near the lakes are naturally going to pull in more income during the warmer months than during the winter. These factors are worth considering when you are budgeting for your airbnb investment. Make sure to tuck away some of that peak season income for the slower months.

The Greater Austin area offers a number of attractive opportunities for Airbnb investors, with solid rental income potential, high occupancy rates, and a variety of top-performing neighborhoods to choose from. But when you’re trying to choose the best area, you need to look at the facts. We have thorough data on all the rental income trends for airbnbs throughout greater Austin, understand the rules and regulation for STRs, and have all the tips and tricks to make sure you maximize your investment by furnishing and operating it at the highest level.