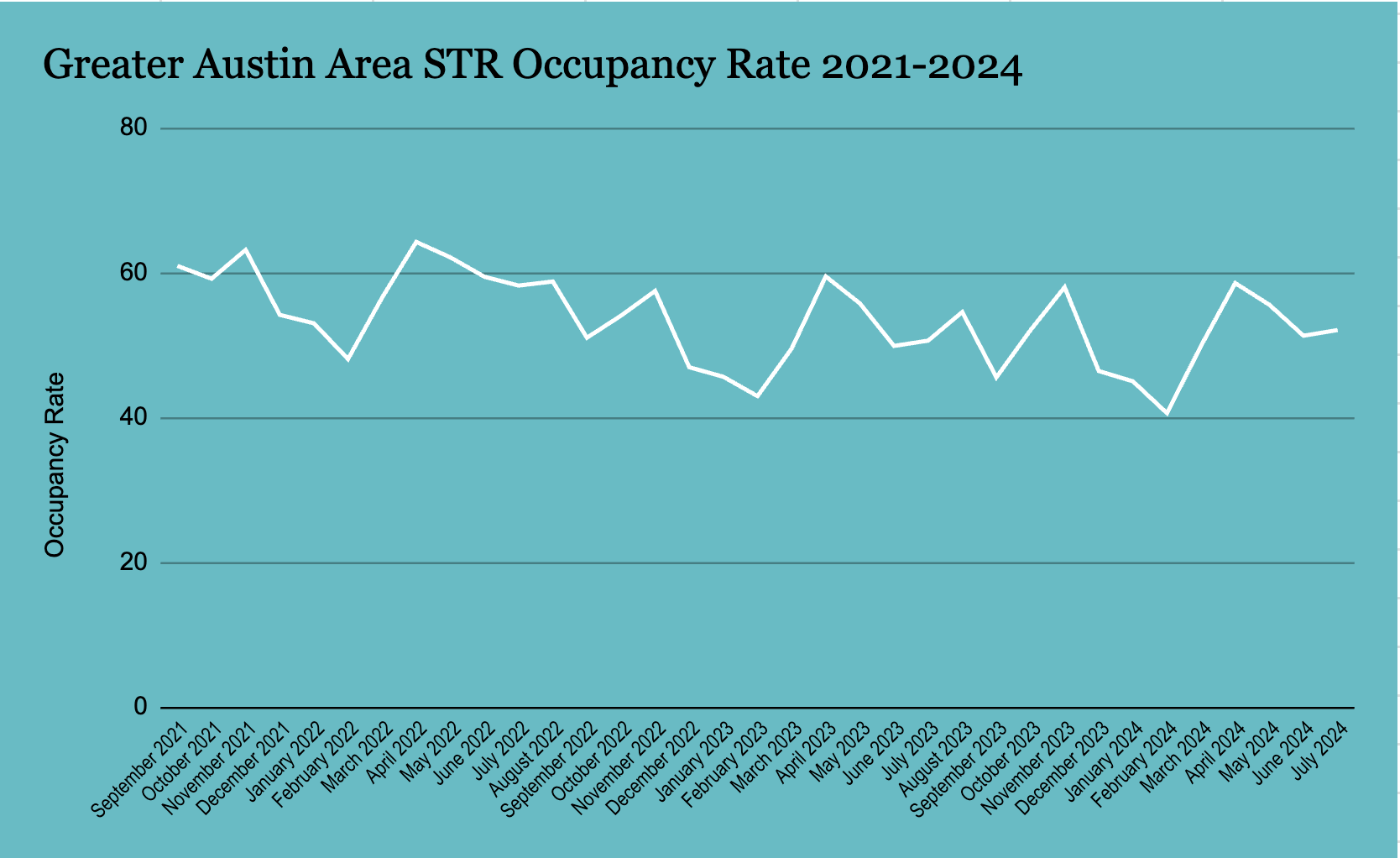

The short term rental (STR) market in Austin, Texas, experiences notable fluctuations throughout the year, heavily influenced by various local events and seasonal changes. Understanding these patterns can help STR owners maximize their revenue and occupancy rates. Here's an in-depth look at the seasonal trends in the airbnb space from 2021 to 2024.

High Season: March Madness and Springtime Buzz

March: The Pinnacle of STR Success March consistently stands out as the high season for short term rentals in Austin. This peak is driven by the renowned South by Southwest (SXSW) festival, which attracts thousands of visitors worldwide over a whopping three week period each March.

March 2022: Occupancy Rate: 64.22%, Average Revenue: $5,164.37

March 2023: Occupancy Rate: 59.46%, Average Revenue: $4,621.13

March 2024: Occupancy Rate: 58.54%, Average Revenue: $4,814.59

SXSW not only boosts occupancy rates but also significantly increases average revenue due to higher demand and elevated pricing. The pleasant spring weather further encourages travel, making March the most lucrative month for STR owners in the greater Austin area.

Shoulder Seasons: Spring and Fall Opportunities

April and October: Pleasant Weather and Event-Driven Demand Following March, April and October also offer strong performance opportunities for STRs.

April 2022: Occupancy Rate: 62.09%, Average Revenue: $5,021.69

October 2021: Occupancy Rate: 63.13%, Average Revenue: $5,263.97

In April, the weather remains favorable, and events like the Austin Food & Wine Festival attract visitors. October benefits urban short term rental owners with the Austin City Limits (ACL) Music Festival, a huge three day, two weekend festival contributing to higher occupancy and revenue. For STR owners in the hill country, October is also beneficial as it is the prime wedding season for central Texas.

Low Season: The Dog Days of Summer and Winter Lulls

August: The Heat Takes a Toll August is typically the lowest performing month for STRs in Austin. The scorching summer temperatures sends locals flocking to cooler locales and deters many travelers, leading to a significant dip in both occupancy rates and revenue.

August 2022: Occupancy Rate: 51%, Average Revenue: $4,055.95

August 2023: Occupancy Rate: 45.53%, Average Revenue: $3,512.75

Winter Months: A Dip in Demand December and January also see lower performance, attributed to the off-season for travel and the post-holiday lull.

December 2022: Occupancy Rate: 45.61%, Average Revenue: $3,373.84

January 2023: Occupancy Rate: 42.94%, Average Revenue: $2,953.39

During these months, fewer events and colder weather contribute to reduced travel, impacting occupancy and revenue.

Strategic Planning for STR Owners

Understanding the seasonality in Austin's STR market is crucial for owners to optimize their strategies. By leveraging high-demand periods like March, April, and October, and preparing for the low seasons, owners can better manage their budgeting, pricing and marketing efforts.

High Season Strategies: Increase nightly rates, implement minimum stay requirements, and invest in targeted marketing campaigns to capitalize on peak demand.

Low Season Strategies: Offer discounts, create attractive packages, and enhance property listings to attract budget-conscious travelers.

By aligning with Austin's seasonal trends, STR owners can maximize their returns and ensure steady occupancy throughout the year.